child care tax credit income limit

Total Cost before tax breaks. Form 2441Child and Dependent Care Expenses.

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

To qualify for the maximum amount of 2000 in 2018 a single.

. That depends on the number of children the cost of care and your income. There is a tax. You are entitled to this credit if you.

If you are a working mother and have met all the conditions for. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. Child Care Tax Credit Income Limit.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. 5000 for each child over six years of age at the end of. Two Factors limit the Child Tax Credit.

How much is the income tax credit for 2021. For the 2021 tax. The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going.

The payment for the. The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities. The taxpayers earned income and their adjusted gross income AGI.

Since both parents work full-time and their children are under 13 years of age they qualify for the child care tax credit. The child care expense deduction provides provincial and federal income tax relief toward eligible child care expenses. The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. IRS Tax Tip 2022-33 March 2 2022. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

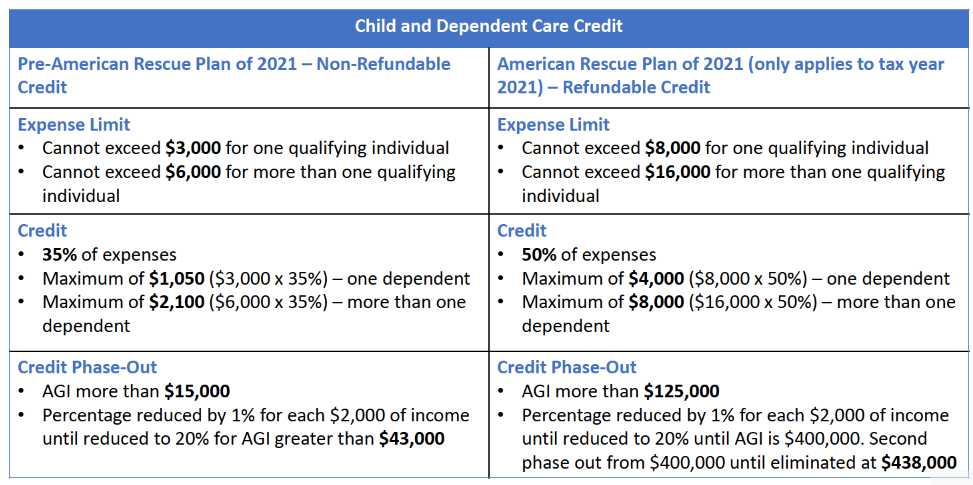

You can count up to 3000 in child-care expenses for one child or up to 6000 for two or more. The credit can be worth up to 2000 per child and it can be used to offset taxes owed. Parents could be eligible for up to 8000 tax credit for child care.

The maximum child tax credit amount will decrease in 2022. This tax credit is a percentage that is based on your adjusted gross income of the amount of work-related childcare expenses that you paid over the course of the year. Form 1040-X Amended US Individual Income Tax Return may be filed electronically.

Qualified to claim the federal child and dependent care credit based on your recomputed FAGI whether you claimed the federal credit. The percentage depends on your income. Because monthly Child Tax Credit payments were not made for qualifying children not listed on your most recent income tax return a qualifying child added in 2021 generally entitles you to.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

How Does The Earned Income Tax Credit Affect Poor Families Tax Policy Center

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Child Tax Credit What Families Need To Know

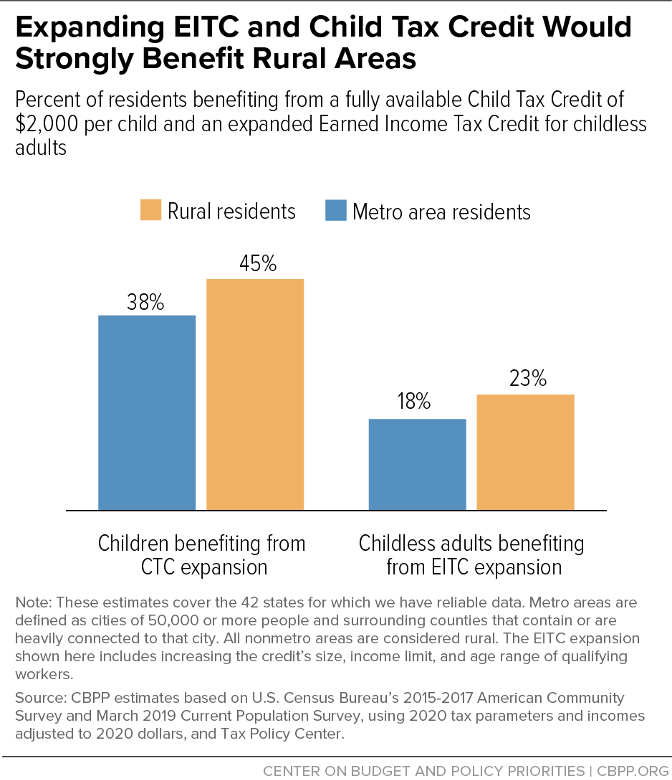

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return Kiplinger

What Build Back Better Means For Families In Every State Third Way

The Child Care Credit And Your Us Expat Tax Return When Abroad

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child And Dependent Care Credit H R Block

What Is The Child Tax Credit Tax Policy Center

The American Families Plan Too Many Tax Credits For Children

2021 Changes To The Child And Dependent Care Credit Form 2441 Support

What To Know About The First Advance Child Tax Credit Payment

What Is The Income Limit For 2019 Child Care Tax Credit Here S How It Changed

2022 Child Tax Credit What Will You Receive Smartasset

The American Families Plan Too Many Tax Credits For Children

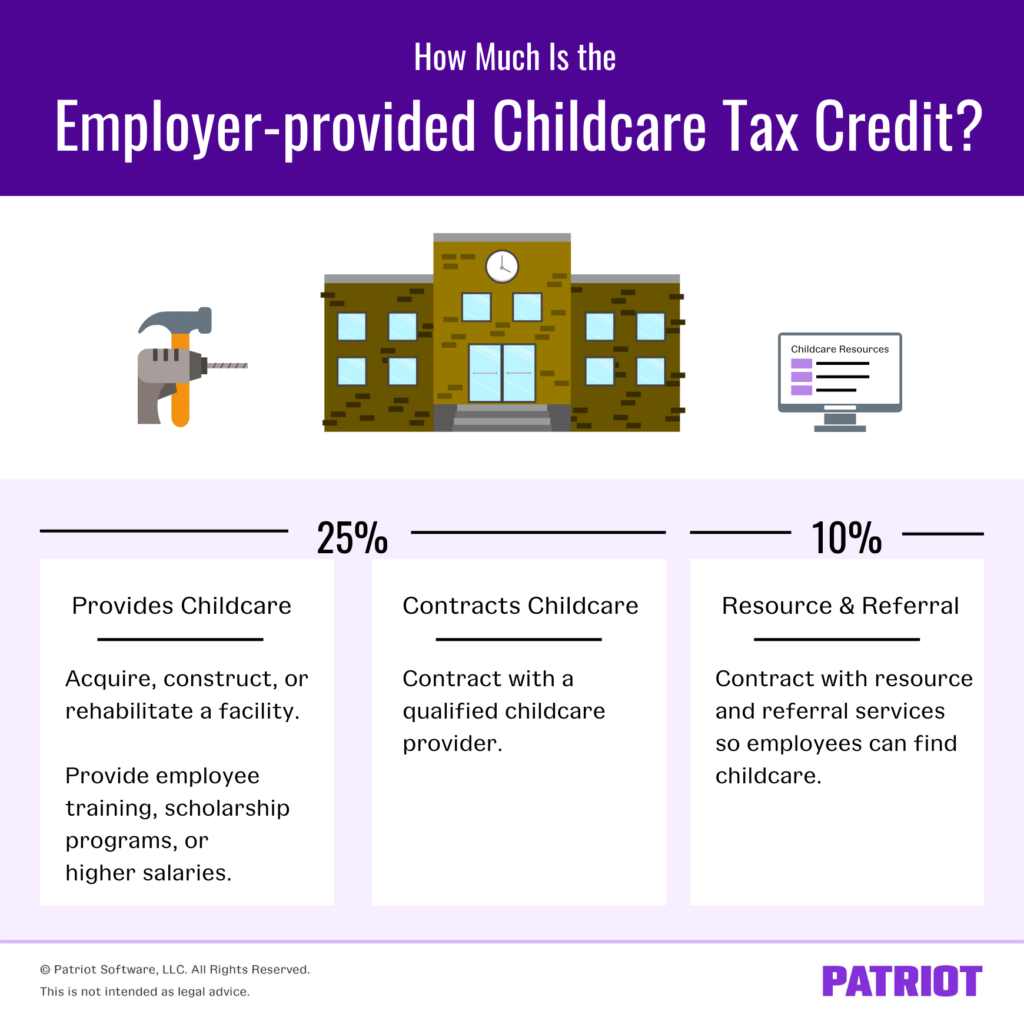

America S Best Kept Secret The Employer Provided Childcare Tax Credit